There are many reasons regarding the absence of a Will when someone passes. Most likely is that they never got around to it, or simply did not think it was necessary. Statistics show that 6 out of 10 people in America die without a will. Despite the reason, it is still necessary to manage the property and possessions the decedent has left behind.

When someone dies without a Will it is referred to them dying Intestate. When this occurs, state intestate law will dictate how the probate process is handled.

Of course, there are many questions that the heirs of the decedent need answered. For instance; How are funeral costs covered? Who is in charge? Who decides how the remaining estate and property will be managed? The following will help answer some of these questions.

Determining Who Controls Probate

In the absence of a Will, there is no sure way to know who the decedent would have selected as the Executor of their estate. This is the person in charge of ensuring the terms of the Will are carried out properly. However, without a Will it is essential to have someone overseeing the estate. Someone who will act as an authority over the decedent’s debts, property, and other lingering matters.

Next Steps:

Meeting with a Probate Attorney is an important step. The heirs will soon find out that they will not be able to access any of the decedent’s assets (if they were not named beneficiary) without the authority to do so.

At the meeting, all parties will discuss a plan up front that everyone can agree on. This plan of action will be implemented over the next coming months to settle the decedent’s estate. Also at this time, it will be determined who will be the Administrator of the estate. Once a decision has been made, the heirs will sign an agreement naming this person. This person will work closely with the Attorney’s office to go over all the assets and debts of the decedent – taking an inventory of all that the decedent owned. And must stay in constant communication with the other heirs as they progress through the probate process.

Implementing the plan:

Soon after, the Attorney will file a petition to open probate on their behalf. The petition is filed with the Clerk of the Circuit Court in the county in which the decedent resided at the time of death. Since there is no Will, the Attorney will need to submit a surety bond along with the petition. This surety bond gives the court assurance that all parties will go through the probate process properly and appropriately.

The Attorney is then given a court date, and at that time the Attorney will present the petition to the Judge. They will ask that the Independent Administrator be given the authority to administer the decedent’s estate. If all is in order, the Judge will then sign an order authorizing the Independent Administrator, and issue the Letters of Office or Letters of Testamentary.

The Administrator now has the Letters of Office, and they are able to access all of the decedent’s assets. They will need to open one or more new Estate accounts, and transfer all funds from the decedent’s other accounts into these new accounts. This gives the Administrator the ability to make any new deposits into the Estate accounts, and pay any expenses from the Estate account.

Who Gets What? Intestate Succession Laws

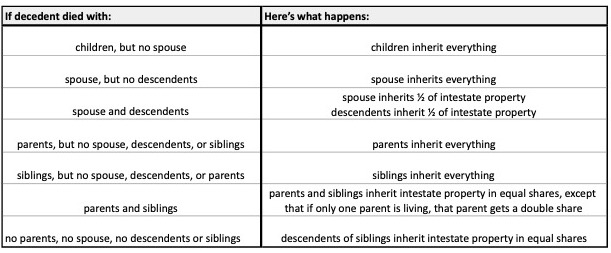

Each and every state has its own unique set of intestate succession laws. These succession laws give a guide for how the decedent’s property shall be divided among their closest kin. These guidelines apply to property that isn’t passed down by a Will, a Living Trust, or other methods.

In Illinois, the intestate law guidelines are as follows:

Those who typically are not considered blood relatives, and therefore are not entitled to the property of the estate include:

- Friends

- Charities

- Unmarried partners

For this reason, it is crucial to draft your own will. Otherwise, laws and guidelines will determine who inherits your property. Leaving many friends and loved ones excluded from having something to remember you by.

What Happens To Minor Children With No Will?

When parents with small children prepare a will, they usually name someone to serve as their children’s personal guardians. If neither parent is accessible, this individual will raise the children. However, the process can certainly become more complicated if there is no official indication.

If a guardian is required and there is no will, the judge must assign one without regard for the preferences of the deceased parent. Before making a decision, the judge will collect as much information as possible about the children, their family situation, and the deceased parents’ desires to make an informed decision. The most important guideline is that the judge must always behave in the children’s best interests.

For these reasons, guardianship of a minor child awarded after the passing of a parent is usually a very specific process with varying results depending on the relevant information. Despite the feelings of surviving family members, no one person is entitled to assuming guardianship if a parent passes before officially selecting someone to care for their young children.

Are There Exemptions For Certain Assets?

It is important to remember that many assets don’t pass by a will in the first place. The following are examples of assets that are not subject to the terms of a will or state intestate succession law:

- Life insurance

- Property held in a living trust

- Property held in Joint Tenancy

- IRA, 401(k), and retirement plan funds when a beneficiary was previously named

- Real estate, assets, and bank accounts held with other parties

- Payable on death accounts

Final Thoughts

While state laws help to ensure a decedent’s property is divided among their surviving family members, these laws often do not reflect the wishes of the deceased. The easiest and most effective way to ensure your property is properly managed after you pass is by creating a Will. Wills guarantee that property is divided and managed exactly how the decedent chooses.

If you would like more information on the probate process in Illinois, please contact me for a no obligation consultation. I would be happy to discuss your specific situation and help you navigate these difficult waters. My name is Maria Mastrolonardo, I am a Illinois Certified Probate Real Estate Specialist with RE/MAX Enterprises. This is ALL I do; I help guide families through the process of selling real estate in probate and I would be happy to help you as well.

Call me today at: (630) 248-6077, or email me at mmastrolonardo@remax.net